Are you interested in understanding how professionals evaluate stock prices? Do you want to learn a method that investment experts use to determine the fair value of stocks that pay dividends? If so, this guide will explain the Gordon Growth Model – a useful framework for valuing dividend-paying stocks.

Created by American economist Myron J. Gordon, this model is widely applied in stock analysis. It is particularly applicable for stocks expecting to have steady dividend growth into the future. By understanding the key components and calculations of the Gordon Growth Model, investors can make more informed decisions when analyzing dividend stocks.

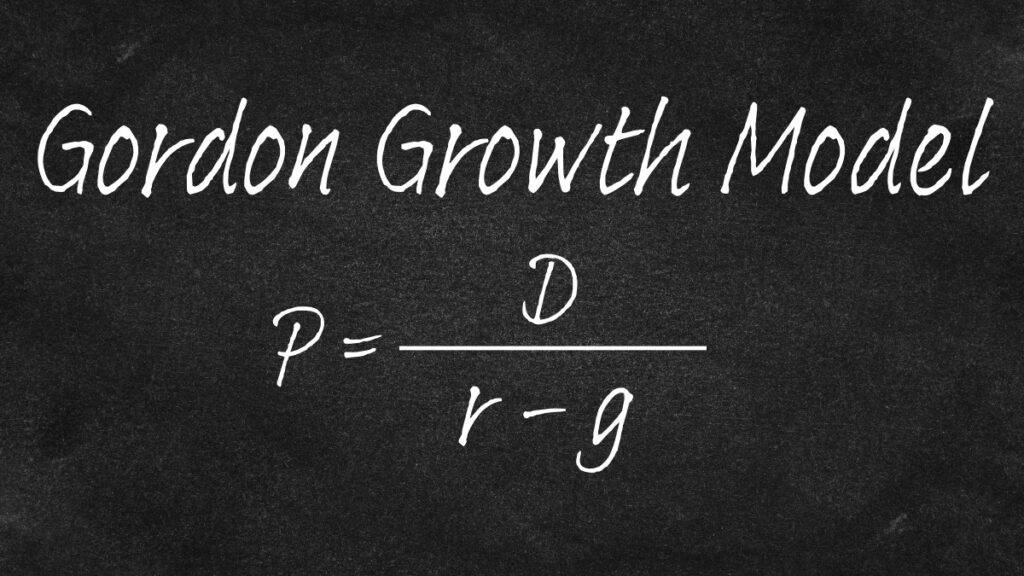

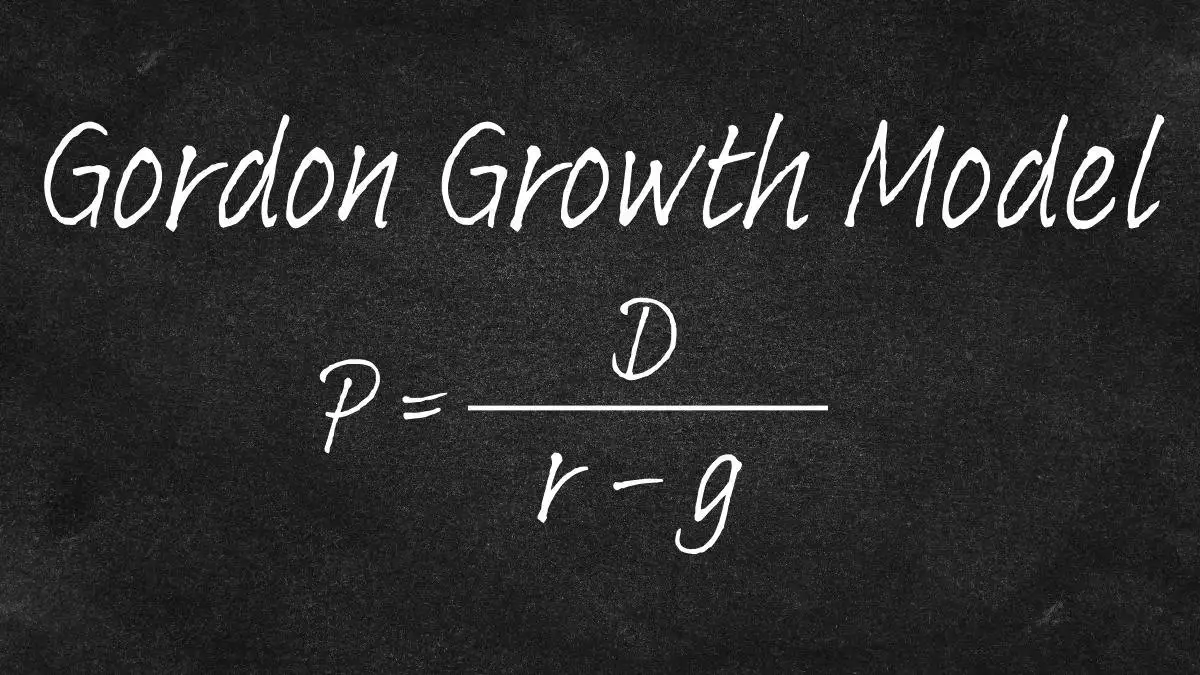

Breaking Down the Formula

The Gordon Growth Model calculates a stock’s intrinsic value based on the following formula:

Let’s examine what each element represents:

- Stock Price (P): The fair or intrinsic value of the stock based on the model

- Next Year’s Expected Dividend (D): The total dividend per share anticipated in the next year

- Required Return (r): The minimum return percentage desired by the investor

- Dividend Growth Rate (g): The expected annual growth rate of the stock’s dividend payments

By plugging in estimated values for these components, the model generates an intrinsic value that you can compare to the current market price. The approach provides insights for investment decision-making.

Examining the Core Components of the Model

To properly apply the Gordon Growth Model, we need to understand what each element represents:

Dividends – The Investor’s Share of Profits

Dividends are cash payments that a company distributes to shareholders from its profits. In the context of this model, we focus on forecasting next year’s expected dividend per share. This represents the tangible income an investor would earn annually from holding the stock at the current price. When analyzing a stock, investors estimate future dividends based on payout ratios and earnings forecasts.

Required Return – The Investor’s Minimum Hurdle Rate

The required return is the minimum rate of return an investor demands on the investment to meet their goals. This threshold compensates the investor for the risk of owning the stock rather than alternative investments. It reflects personal risk tolerance and opportunity cost. Investors with a higher risk appetite may have a lower required return. The required return also accounts for the broader market’s expected returns.

Growth Rate – The Company’s Expected Profit Trajectory

The growth rate is the expected annual rate of increase in the company’s dividend payments. It indicates the projected earnings growth that would support steadily rising dividends. A higher growth rate implies stronger profit growth potential. However, the assumed growth rate must be reasonably achievable for the business. Unrealistically high growth assumptions will skew the model’s valuation.

Applying the Model – Valuing a Stock Step-by-Step

Now that we have reviewed the key variables, let’s walk through how to use the Gordon Growth Model to value a stock:

Step 1) Estimate the Inputs

- Next Year’s Expected Dividend Per Share: Forecast the total dividend you expect the company will pay per share over the next year based on its dividend policy.

- Required Return: Determine your minimum acceptable return percentage for this stock investment based on your risk tolerance.

- Expected Dividend Growth Rate: Project the average annual growth rate you believe the company can sustainably achieve for its dividend payments.

Step 2) Plug the Estimates into the Formula

Take your estimated values for the three inputs and plug them into the Gordon Growth Model formula:

Step 3) Calculate the Intrinsic Value

Perform the calculation to determine the stock’s intrinsic value based on the model.

Step 4) Compare to the Current Price

Compare the intrinsic value result to the stock’s current market price. This sheds light on whether the stock is potentially undervalued or overvalued.

By methodically forecasting the key estimates and calculating intrinsic value using the Gordon Growth Model, investors can make more informed decisions when analyzing dividend-paying stocks.

Walking Through a Step-by-Step Example

To better understand how to apply the Gordon Growth Model, let’s walk through a detailed example with sample data:

The Parameters

For our example, let’s assume the following inputs:

- Next Year’s Expected Dividend Per Share: $2.00

- Required Return: 10%

- Expected Dividend Growth Rate: 5%

Performing the Calculation

Now we will take these parameters and calculate the stock’s intrinsic value step-by-step:

Step 1) Identify the Input Values: First, we start by clearly stating our assumptions for the next year’s dividend ($2.00), required return (10%), and growth rate (5%).

Step 2) Plug Inputs into the Formula: Then, we take these values and substitute them into the formula as follows:

Step 3) Calculate the Intrinsic Value: Based on our inputs, the model calculates the stock’s intrinsic value to be $40.

Step 4) Evaluating the Result: Lastly, we now compare the intrinsic value to the current market price to evaluate if the stock is over or undervalued:

- If the current price < $40, the stock may be undervalued

- If the current price > $40, the stock may be overvalued

This example illustrates how to practically apply the Gordon Growth Model using estimated inputs to calculate a stock’s intrinsic value for analysis.

Considering the Model’s Limitations

Like any analytical model, the Gordon Growth Model has some inherent limitations to keep in mind:

- It assumes a constant dividend growth rate, which may not perfectly reflect real-world variability.

- The model treats the required return as static, when it may shift over time.

- The model is best suited for analyzing stocks that pay steady dividends. Non-dividend-paying stocks require other valuation approaches.

While a useful tool, you should apply the Gordon Model with these considerations in mind. Supplementing with other valuation techniques can provide a more complete analysis.

Avenues for Further Learning

For those looking to deepen their expertise in business valuation, a wide array of resources are available:

Books:

- “Investment Valuation: Tools and Techniques for Determining the Value of Any Asset” by Aswath Damodaran – The definitive guide to valuation concepts and methods.

- “The Intelligent Investor” by Benjamin Graham – A classic text on value investing approaches from the “father of value investing.”

- “Common Stocks and Uncommon Profits” by Philip Fisher – Insights on identifying innovative companies with strong growth potential.

Online Courses:

- Coursera: “Investment Management Specialization“

- Aswath Damodaran’s Website: “Valuation: Online Class“

This sampling of resources provides pathways for enriching one’s understanding of the Gordon Model, valuation, and investments.

Closing Thoughts on the Gordon Growth Model

In summary, the Gordon Growth Model is a useful valuation tool for dividend-paying stocks. It provides investors with a framework for estimating the fair value of a stock based on its future dividend income potential.

By forecasting the key inputs of next year’s expected dividend, required return, and dividend growth rate, investors can calculate the stock’s intrinsic worth according to the model. Comparing this to the current market price allows for more informed investment decision-making.

However, the model does have limitations, such as its assumptions of constant growth and static required return. As such, you should apply the Gordon Growth Model as one valuation approach within a more holistic analysis. Investors should supplement it with other techniques like discounted cash flow analysis or comparable company multiples.

Embracing a multi-faceted valuation approach allows investors to overcome the inherent constraints of individual models. This provides a more robust estimate of a stock’s fair value aligned with one’s goals and risk appetite. With knowledge of the Gordon Growth Model’s mechanics and prudent application, investors can make strategic investment decisions anchored in fundamental valuation principles.

Overall, the Gordon Growth Model serves as a cornerstone concept in modern valuation theory. Mastering its workings can aid investors in their quest to value dividend stocks, construct profitable portfolios, and achieve long-term financial objectives.

Before you go…

- Subscribe via email to receive future articles and updates.

- Share this post with friends and colleagues who may find it insightful.

Disclaimer: This article reflects the author’s opinion and is not financial advice. The author is not a licensed financial advisor. Content is for informational purposes only. Consult a qualified financial professional before making investment decisions.

This post may contain affiliate links, which means I may receive a commission if you click a link and make a purchase. However, my opinions and recommendations remain my own, uninfluenced by any potential earnings.