Today, we’re diving into a fascinating realm where mathematics, psychology, and business strategy converge. Yes, we’re talking about game theory.

Game theory, a concept that has its roots in mathematics, has found its way into the boardrooms of the world’s most successful companies. It’s a tool that can help businesses predict competitors’ moves, make strategic decisions, and ultimately gain a competitive edge. If you’ve ever wondered how chess masters think several moves ahead, you’re already getting a sense of what game theory is all about.

In this article, we’ll journey through the intriguing world of game theory. We’ll start by demystifying what game theory is and how it works. Then, we’ll delve into its application in business strategy, exploring how it can help predict competitors’ moves and aid in decision-making. We’ll also discuss the key elements of game theory in business and introduce you to some of the most common game theory models used in strategic planning.

We’ll bring these concepts to life with real-world examples of game theory in action and discuss the challenges and limitations of applying game theory in a business context. And, as always, we’ll wrap things up with a recap and some food for thought for your own strategic planning.

So, whether you’re a budding entrepreneur, a business student, or a seasoned executive looking for fresh insights, this article is for you. Let’s get started on this game-changing journey.

What is Game Theory?

Game theory, in its simplest form, is the study of mathematical models of strategic interaction among rational decision-makers. It’s like the chess of the business world, where each move you make influences the moves of your competitors, and vice versa.

The idea of game theory isn’t exactly a recent innovation. It was first developed in the 1940s by mathematician John Nash (yes, the one from “A Beautiful Mind“) and economists Oskar Morgenstern and John von Neumann. They were trying to find a way to predict human behavior in competitive situations, and voila, game theory was born.

Now, let’s break down how game theory works. At its core, game theory involves three main elements: players, strategies, and payoffs.

- Players: These are the individuals or groups making decisions. In business, players could be companies competing in the same market.

- Strategies: These are the actions that each player can take. For example, a business might decide to lower its prices to attract more customers.

- Payoffs: These are the outcomes that result from the combination of strategies chosen by all players. In our example, the payoff for the business that lowered its prices could be increased sales, but it could also be lower profit margins.

Let’s illustrate this with a simple example. Imagine two ice cream shops – Scoops Ahoy and Sundae Funday – located on the same street. Both shops are deciding whether to offer a discount on their ice cream (their strategies). If only one shop offers a discount, that shop will attract more customers (a positive payoff). But if both shops offer a discount, they might attract an equal number of customers, and their profits could decrease due to the lower prices (a negative payoff). If neither shop offers a discount, they maintain their current customer base and profit margins (a neutral payoff).

Through game theory, both Scoops Ahoy and Sundae Funday can analyze this situation and make strategic decisions based on the potential actions of their competitor.

Game Theory in Business Strategy

Imagine if you could predict your competitor’s next move. You’d always be one step ahead, right? Well, that’s where game theory comes into play in the business world.

Game theory allows businesses to anticipate the actions of their competitors based on the understanding that their decisions will not be made in isolation but will be influenced by the actions of others. It’s like being able to see the future, but instead of a crystal ball, you’re using strategic analysis and rational decision-making.

Let’s go back to our ice cream shop example. If Scoops Ahoy knows that Sundae Funday is planning to offer a discount, they can preemptively decide to offer a discount as well, launch a new flavor, or start a marketing campaign to retain their customers. By predicting Sundae Funday’s move, Scoops Ahoy can make a strategic decision that best suits their business goals.

Decision-Making and Strategic Planning

Game theory isn’t just about predicting competitors’ moves. It’s also a powerful tool for decision-making and strategic planning.

In business, every decision comes with its own set of potential outcomes or payoffs. Game theory provides a framework for evaluating these payoffs and making rational decisions. It helps businesses answer questions like: Should we enter this new market? Should we invest in this new technology? Should we lower our prices or focus on improving our product?

Moreover, game theory encourages businesses to think long-term. It’s not just about the immediate payoffs but also about how today’s decisions will affect future interactions with competitors and the overall market dynamics.

For instance, a company might decide not to enter a price war with a competitor, not because they can’t afford to lower their prices now, but because they want to avoid setting a precedent for future price competitions.

In essence, game theory provides businesses with a strategic lens to view their decisions, not as isolated events but as interconnected moves in a complex game of business strategy. So, the next time you’re faced with a tough business decision, remember: it’s all just part of the game.

Players: Identification of Competitors

In the grand game of business, the players are key. These are the individuals or entities making decisions, and in most cases, they’re your competitors. Identifying your competitors is the first step in applying game theory to your business strategy.

But remember, competitors aren’t just the businesses offering the same products or services as you. They can also be companies targeting the same customer base or even potential entrants to your market. So, keep your eyes wide open and your competitor radar on high alert.

Strategies: Possible Actions Each Player Can Take

Once you’ve identified your competitors, it’s time to think about strategies. In game theory, a strategy is a comprehensive plan of action a player can take.

In business, strategies can range from pricing decisions, marketing campaigns, product development, partnerships, and more. The key is to consider all possible actions you and your competitors can take. It’s like mapping out all the possible moves on a chessboard.

Remember, a good strategy isn’t just about reacting to your competitors’ moves. It’s about proactively planning your actions to shape the competitive landscape and influence your competitors’ decisions.

Payoffs: The Potential Outcomes from Each Strategy

Finally, we come to payoffs. In game theory, payoffs represent the outcomes that result from the combination of strategies chosen by all players.

In the business context, payoffs can be measured in various ways, such as profit margins, market share, brand reputation, customer satisfaction, and more. The potential payoff of a strategy is a crucial factor in decision-making.

However, it’s important to note that payoffs aren’t always clear-cut or immediate. Some strategies may have a high potential payoff but also come with a high level of risk or require a long-term investment.

Understanding the potential payoffs of your strategies and those of your competitors can help you make informed, rational decisions that align with your business goals and risk tolerance.

The Prisoner’s Dilemma and Its Relevance to Business Strategy

One of the most famous models in game theory is the Prisoner’s Dilemma. Picture this: two criminals are arrested and held in separate cells. Each has two options – stay silent or betray the other. If both stay silent, they get a light sentence. If one betrays the other, the betrayer goes free while the other gets a heavy sentence. If both betray each other, they both get a moderate sentence. Let’s take a look at an example scenario.

| Suspect B Stays Silent | Suspect B Betrays Other | |

| Suspect A Stays Silent | Both get 1 year | A gets 10 years, B goes free |

| Suspect A Betrays Other | A goes free, B gets 10 years | Both get 5 years |

In business, the Prisoner’s Dilemma often plays out in competitive situations where companies could benefit from cooperation but are tempted to act in their own self-interest. For example, two competing businesses might both benefit from keeping prices high, but each has the incentive to lower prices to attract more customers. If both lower their prices, they could end up in a price war, hurting both businesses.

The Prisoner’s Dilemma teaches us that what’s best for the individual player isn’t always best for the group. It encourages businesses to consider the broader implications of their decisions and seek out opportunities for cooperation.

The Nash Equilibrium and Predicting Competitor Behavior

Another key concept in game theory is the Nash Equilibrium, named after its creator, John Nash. A Nash Equilibrium occurs when no player can gain by changing their strategy while the other players keep theirs unchanged. In other words, it’s a state of play where everyone’s doing the best they can, given what their competitors are doing.

In business, the Nash Equilibrium can help predict competitor behavior. If a market is in a Nash Equilibrium, companies can anticipate that their competitors will unlikely change their strategies unless there’s a change in the market conditions.

Other Notable Game Theory Models in Business

There are several other game theory models that can be useful in business strategy. For instance, the Cournot Competition model can help businesses determine the optimal level of production in a market where competitors are deciding how much to produce. The Bertrand Competition model, on the other hand, is useful in markets where businesses are competing on price.

Another interesting model is the Game of Chicken, which describes a situation where two players are headed for a direct conflict, and the one who yields is seen as the ‘chicken’. It’s often seen in business negotiations, where each party must decide whether to push for their own interests or yield to avoid a negative outcome.

These models, along with the Prisoner’s Dilemma and Nash Equilibrium concepts, are just a few examples of how game theory can provide valuable insights into business strategy.

Game Theory in Action

The OPEC Oil Production Decision

One of the most significant examples of game theory in business is the Organization of Petroleum Exporting Countries (OPEC). This group of 13 oil-producing countries often faces a classic game theory dilemma: Should they increase oil production to gain more market share, or should they limit production to keep oil prices high?

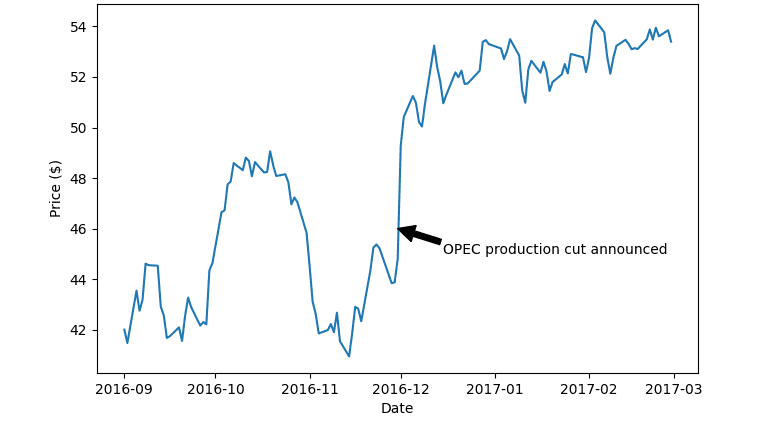

In 2016, OPEC members decided to cut oil production to combat falling oil prices. This decision was based on game theory analysis, recognizing that while each member could benefit individually from increasing production, they would all benefit more if they collectively reduced production to drive up prices. The strategy worked, leading to a significant increase in oil prices and demonstrating the power of cooperation in game theory.

Crude Oil Prices September 2016 – February 2017

The HD DVD vs. Blu-ray War

On the flip side, neglecting game theory can lead to strategic failure, as seen in the HD DVD vs. Blu-ray war in the mid-2000s. Both formats were developed as the successor to the DVD, leading to a fierce competition similar to the VHS vs. Betamax war in the 1980s.

Instead of cooperating to develop a single format or finding a way to make the two formats compatible, the companies behind HD DVD and Blu-ray decided to compete, hoping that their format would dominate the market. This led to a split market, with consumers hesitant to buy either format for fear of choosing the “losing” technology.

Eventually, major movie studios and retailers began choosing sides, with most backing Blu-ray. HD DVD was discontinued in 2008, but the format war had slowed the adoption of new technology and caused confusion among consumers. This case serves as a reminder of the potential negative outcomes when businesses fail to consider the strategic interactions with their competitors.

These examples highlight the importance of game theory in business strategy. Whether deciding on production levels or launching a new technology, considering your competitors’ potential actions and reactions can lead to more informed and strategic decisions.

Complexities and Constraints of Applying Game Theory

While game theory offers valuable insights into business strategy, it’s not without its challenges and limitations. One of the main complexities is the assumption of rationality. Game theory assumes that all players are rational and will make decisions that maximize their own payoffs. However, in the real world, decisions can be influenced by a variety of factors, including emotions, biases, and imperfect information.

Moreover, game theory often relies on the idea of common knowledge, where all players know the payoffs and strategies of all other players. In reality, businesses often operate under uncertainty and have incomplete information about their competitors.

Additionally, applying game theory models can be complex and require a deep understanding of the mathematical principles involved. Identifying the players, strategies, and payoffs in a given situation is not always straightforward, and the optimal strategy can change as the game evolves.

Strategies to Mitigate These Challenges

Despite these challenges, there are ways to make game theory more applicable and useful in a business context.

First, while game theory assumes rationality, it can be adapted to consider bounded rationality, where players make rational decisions within the limits of their knowledge and information. Businesses can also use behavioral economics and psychology to understand how emotions and biases can influence decision-making.

Second, businesses can invest in market research and competitive intelligence to gather as much information as possible about their competitors. While achieving perfect information is unlikely, more data can lead to better predictions and strategies.

Finally, businesses can seek help from experts or use software tools that can simplify the application of game theory models. This can make game theory more accessible and practical for strategic decision-making.

While game theory has its challenges and limitations, it remains a powerful tool for understanding strategic interactions in business. By acknowledging these challenges and finding ways to mitigate them, companies can harness the power of game theory to gain a competitive edge.

Wrapping Up

And there you have it, folks – a deep dive into the fascinating world of game theory and its application in business strategy. We’ve journeyed through the definition and workings of game theory, explored its role in predicting competitor moves and decision-making, and examined some of the challenges and limitations of its application.

We’ve seen how game theory can illuminate the strategic interactions between businesses, helping us understand that our decisions don’t exist in a vacuum but are part of a complex web of actions and reactions. From the OPEC oil production decision to the HD DVD vs. Blu-ray war, real-world examples have shown us the power of game theory in action – and the consequences of neglecting it.

As we wrap up, consider game theory in your strategic planning. Whether you’re deciding on pricing, production levels, or market entry, game theory can provide valuable insights into your competitors’ potential actions and reactions. It’s not just about making the best move but also about anticipating the moves of others.

Remember, business is a game, and with game theory, you can be one step ahead. So, keep exploring, keep learning, and keep playing the game. After all, as we know, life’s too short to be a spectator.

Suggested Resources

While we’ve covered a lot in this article, there’s always more to learn. For those of you who are interested in diving deeper into game theory, I’ve compiled some additional resources that you might find helpful.

- “The Art of Strategy: A Game Theorist’s Guide to Success in Business and Life” by Avinash K. Dixit and Barry J. Nalebuff. This book provides a comprehensive introduction to game theory and its applications in various fields, including business.

Available as Kindle, Audiobook, Hardcover, Paperback, or Audio CD

- “Game Theory 101: The Complete Textbook” by William Spaniel. This textbook is a great resource for those who want to understand the mathematical principles behind game theory.

Available as Kindle or Paperback

- “Game Theory: An Introduction” by Steven Tadelis: This book offers a more advanced look at game theory, focusing on its applications in economics and business.

Available as eTextbook or Hardcover

- For online learners, Coursera offers a course called “Game Theory” by Stanford University and The University of British Columbia. This course covers the fundamentals of game theory and includes a variety of real-world applications.

Knowledge is power, and the more you know about game theory, the better equipped you’ll be to navigate the strategic landscape of business. Until next time, stay curious and stay ahead of the game!

Note: While I strive to provide accurate and insightful content, I encourage readers to seek professional advice before making any significant business decisions. This article is intended for informational purposes only and does not constitute professional advice.

This post may contain affiliate links, which means I may receive a commission if you click a link and make a purchase. However, my opinions and recommendations remain my own, uninfluenced by any potential earnings.

Enjoyed the read? Subscribe to my blog and spread the word by sharing this article with your circles!

I’d love to hear your take on the subjects we’ve covered in this post. Drop a comment or question below. Let’s keep this conversation going!