Imagine you’re considering investing in two companies. Company A’s stock is priced at $50, while Company B’s is at $100. Which one is the better deal? At first glance, you might think Company A is cheaper and therefore a better investment. But what if I told you there’s a helpful metric that could provide additional perspective?

Enter Earnings Per Share (EPS) – an important tool that can enhance the way you evaluate potential investments. EPS goes beyond stock prices and market caps to reveal a valuable insight: how much profit a company is generating for each share of its stock.

In this article, I’ll explain EPS, showing you how to calculate it, interpret it, and use it to make more informed investment decisions. No matter whether you’re new to investing or looking to refine your analytical skills, understanding EPS can be beneficial in your investment analysis process.

Let’s explore the concept of EPS and how it can contribute to your investment decision-making.

What is Earnings Per Share (EPS)?

Earnings Per Share represents the portion of a company’s profit allocated to each outstanding share of common stock. It serves as a simple indicator of a company’s profitability and is widely used by investors and analysts to evaluate a company’s financial performance.

Why is EPS Important?

EPS is a significant metric for several reasons:

- Profitability Measure: It provides a clear view of a company’s ability to generate profit for shareholders.

- Comparative Analysis: EPS allows for comparison between companies of different sizes within the same industry.

- Performance Tracking: By monitoring EPS over time, investors can identify trends in a company’s financial performance.

- Valuation Tool: EPS is a vital component in various valuation ratios, such as the Price-to-Earnings (P/E) ratio.

- Dividend Considerations: Companies with higher EPS may have more capacity to pay dividends or reinvest in growth.

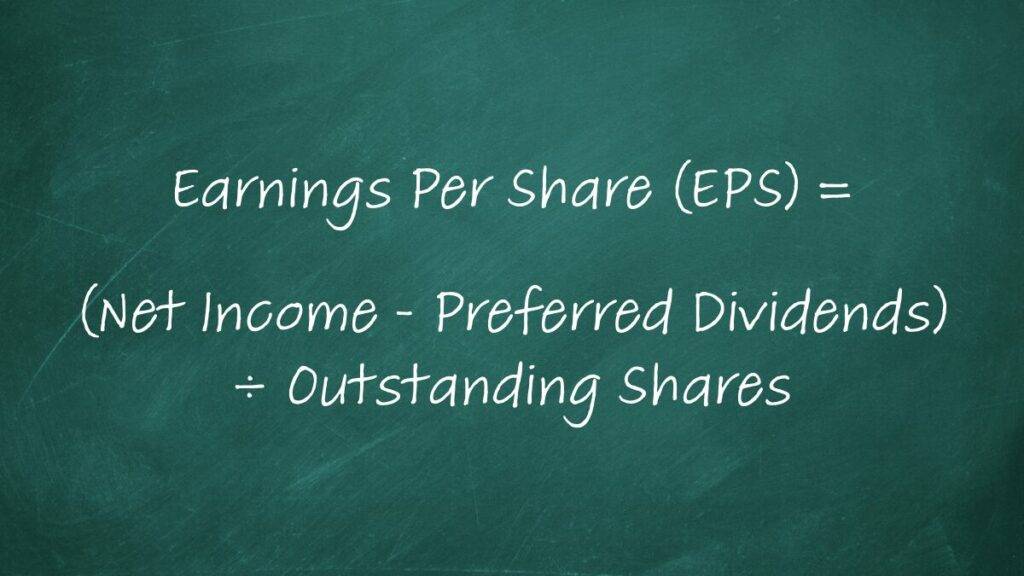

How to Calculate EPS

The formula for calculating basic EPS is:

EPS = (Net Income – Preferred Dividends) / Outstanding Shares

Let’s break down each component:

- Net Income: This is the company’s total profit after subtracting all expenses, taxes, and costs.

- Preferred Dividends: These are payments made to preferred stockholders, which are subtracted as they’re not available to common stockholders.

- Outstanding Shares: This refers to the total number of shares currently held by all shareholders.

An Illustrative Example

Let’s consider a hypothetical company, “TechInnovate, Inc.” with the following financial data:

- Net Income: $10,000,000

- Preferred Dividends: $1,000,000

- Outstanding Shares: 3,000,000

Applying our EPS formula:

EPS = ($10,000,000 – $1,000,000) / 3,000,000 shares

EPS = $9,000,000 / 3,000,000 shares

EPS = $3 per share

This result indicates that TechInnovate, Inc. has earned $3 for each outstanding share of its common stock.

Implications for Investors

An EPS of $3 suggests that TechInnovate Inc. is generating substantial profits relative to its number of outstanding shares. However, it’s important to note that EPS doesn’t directly translate to personal gains for shareholders. The company has several options for utilizing these earnings, including:

- Reinvestment in the business

- Saving for future expenses or opportunities

- Paying down debt

- Distributing dividends

For investors, a healthy and growing EPS often indicates potential for long-term value, either through stock price appreciation or dividend payments.

Key Considerations

While EPS is a valuable metric, it’s important to consider it in context:

- Industry Comparisons: EPS can vary significantly between industries. It’s most useful when comparing companies within the same sector.

- Historical Trends: Examining EPS over time can reveal important patterns in a company’s financial performance.

- Calculation Methods: Be aware of different EPS calculations, such as basic EPS versus diluted EPS, which accounts for all potential shares.

- Comprehensive Analysis: EPS should be considered alongside other financial metrics and qualitative factors for a complete picture of a company’s health.

- Forward-Looking Perspective: While EPS reflects past performance, investors should also consider a company’s future growth potential.

Expanding Your Investment Analysis Toolkit

Although mastering EPS is a significant step in becoming a well-educated investor, it’s just one of many relevant formulas and metrics used in investment analysis. To truly elevate your investment strategy, you need a comprehensive understanding of various financial metrics and how they work together.

This is where my “Investing Formulas Quick Guide” comes in. This handy resource is designed to take your investment analysis skills to the next level. It covers 12 essential investing formulas, including EPS and other vital metrics like:

- Price-to-Earnings (P/E) Ratio

- Return on Investment (ROI)

- Dividend Yield

- Net Present Value (NPV)

Each formula in the guide is explained in clear, easy-to-understand language, complete with simplified examples and pro tips for interpretation. Regardless if you’re a beginner looking to build a solid foundation or an experienced investor aiming to refine your skills, this guide is a valuable addition to your financial toolkit.

By mastering these formulas, you’ll be able to:

- Evaluate companies more comprehensively

- Compare investment opportunities with confidence

- Make data-driven decisions that align with your investment goals

Ready to take your investment analysis to the next level? Check out the “Investing Formulas Quick Guide” here. It’s the perfect companion to help you apply what you’ve learned about EPS and discover even more powerful tools for successful investing.

Conclusion

Understanding and effectively using EPS in your investment analysis can significantly enhance your decision-making process. It provides a simple, quantifiable measure of a company’s profitability on a per-share basis.

However, it’s crucial to remember that EPS is just one piece of the larger financial puzzle. To make well-informed investment decisions, combine your understanding of EPS with other financial metrics, industry knowledge, and thorough research into a company’s overall business model and growth prospects.

As you continue to develop your investment strategy, you’ll encounter many more financial concepts and metrics. Each one adds another layer to your analytical capabilities, helping you make more informed and confident investment choices.

Successful investing is a continuous learning process, and by mastering concepts like EPS, you can build a strong foundation for your investment journey. Keep at it, and before you know it, you’ll be surprised at how much you’ve learned.

Disclaimer: This article reflects the author’s opinion and is not financial advice. The author is not a licensed financial advisor. Content is for informational purposes only. Consult a qualified financial professional before making investment decisions.

Before you go…

- Subscribe via email to receive future articles and updates.

- Share this post with friends and colleagues who may find it insightful.